|

|

|

|

Student

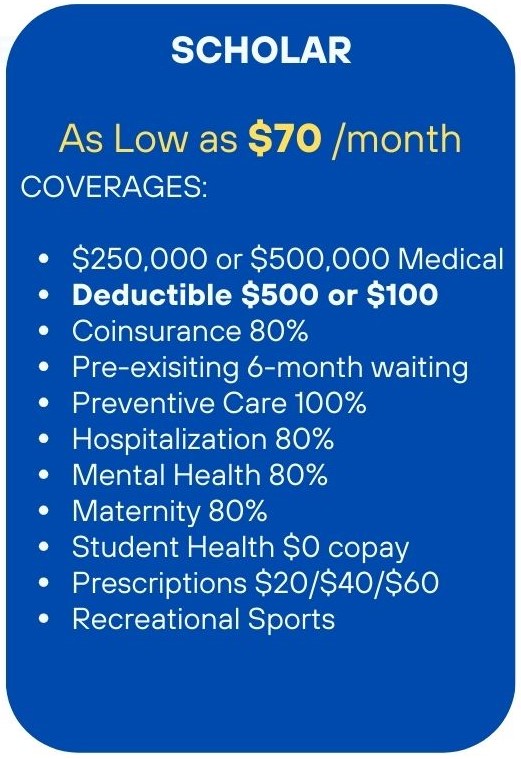

◦ Scholar

◦ OPT ◦ Exchange

◦ Faculty ◦ Family

Health

insurance for International

Students & Scholars provides the

Medical coverage necessary to keep

you healthy and safe while

Studying Abroad - and our low

prices help keep your budget

healthy, too!

Our

F-1 Student

insurance is acceptable to most

Schools, and our

J-1

Student/Scholar insurance

meets your Visa requirements.

VISIT®

Student Health

insurance

is ideal for:

Our Student

health insurance is designed

especially for International

Students & Scholars and Study Abroad

– we’ve done the homework so you

don't have to!

|

|

| |

F-1

& M-1

Students

|

|

|

Unlimited-Medical

Student Insurance

Meets Most School Requirements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Essential

Student Insurance

Meets Many School Requirements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPT Students

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J-1

Student/Scholar

|

|

Meets J-1 visa requirements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Student

Insurance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical Evacuation & Repatriation

available on a stand-alone

basis |

|

|

|

|

|

|

| |

| |

More

Information

STUDENT, SCHOLAR & Exchange Health Insurance |

| For

International Students, Scholars, OPT,

Visiting Teachers & J-1 Visa holders and

their Dependents |

|

|

|

Exclusively offered by VISIT®

|

|

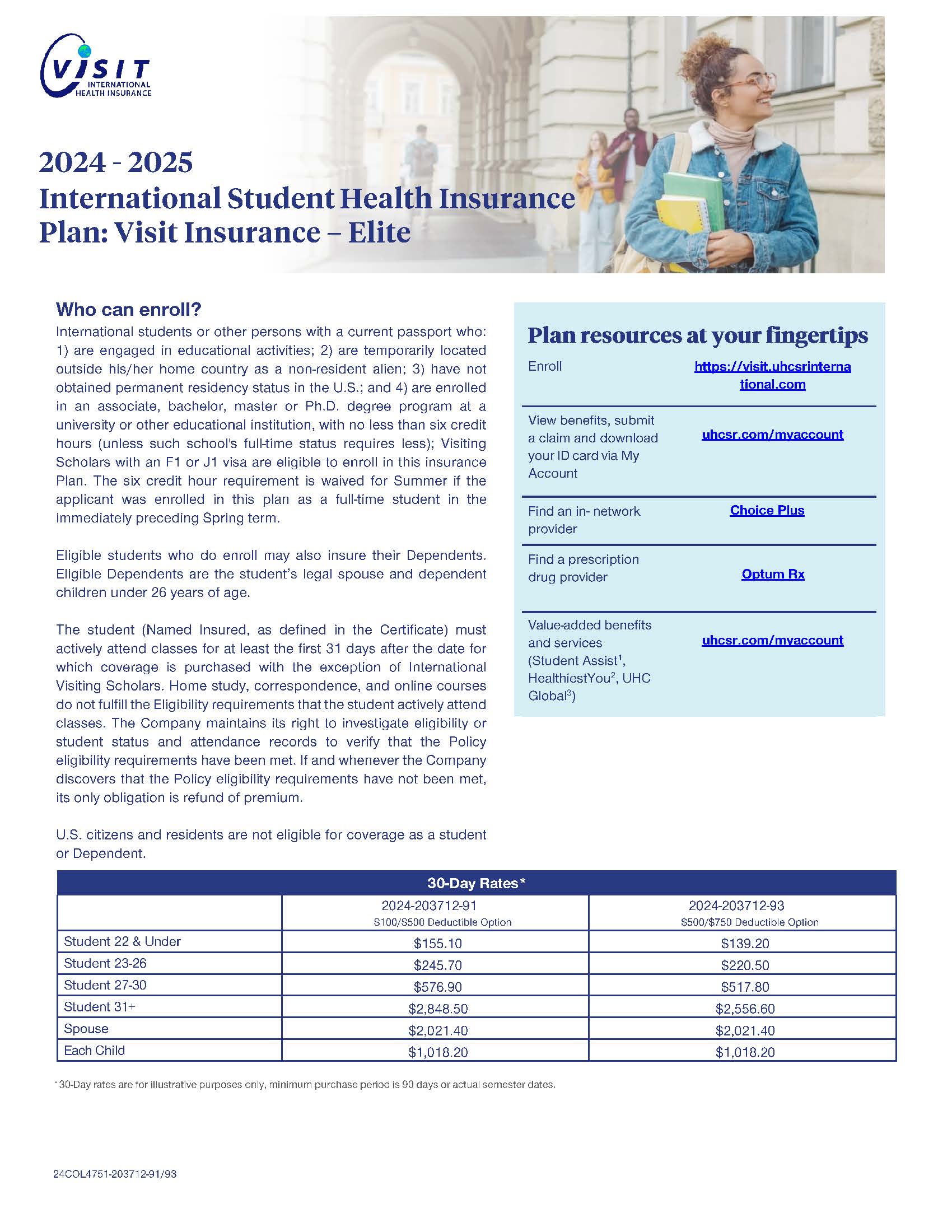

Plan E PLUS

EXPLORER

Ideal for Any International

STUDENTS & STUDY ABROAD Worldwide!

Inexpensive Essential Coverage!

-

Includes COVID coverage

to/from

the USA & Globally

-

Popular and

flexible International Health Insurance for

Students, Scholars, Faculty, Families and

ANY International Travelers and GROUPS for

ANY Reason!

-

Pays 100% of covered medical

expenses after deductible

-

Choose a Medical

Maximum from $100,000 up to $1,000,000 Per

Accident or Illness

-

Choose an

Annual Deductible from $0

to $500

-

EXPLORER is very

competitively priced, and meets or exceeds J-Visa insurance

requirements

-

Includes Medical

Evacuation and Repatriation

- EXPLORER does

not include Maternity

No Visa Required!

Study, Travel, Work, Live – Abroad!

Study &

Travel safely with Plan E PLUS EXPLORER!

|

Essential

Coverage &

Flexible Optional

Coverage

.png)

Plan E PLUS Explorer

Overview

Plan E PLUS Explorer Brochure

Watch Plan E PLUS Explorer Video

Doctors & Hospitals |

| |

| |

|

Patriot Exchange

Program (PEP)

Ideal for Any International STUDENTS and STUDY

ABROAD Worldwide!

-

Medical insurance for Individuals and Groups

involved in Educational or Cultural Exchange

-

Pays 90% (In-Network) of covered medical expenses and

prescriptions after deductible

-

Includes Mental Health coverage

-

Does

not include Maternity or Pre-Existing

Conditions

-

Optional Add-On Rider includes limited coverage

for High School and College Sports

-

Choices of Medical Maximum & Deductible

-

Includes COVID coverage

|

Essential Coverage

&

Includes Mental Health

.png) .png)

PEP

Overview

PEP Brochure

Watch PEP Video

Doctors & Hospitals |

| |

| |

|

VISIT®

Global Care

Essential

(Start date

must be July 1, 2024 or later)

-

Comprehensive

medical insurance for international

students or scholars participating in

educational activities. Must be

enrolled in an Associates, Bachelors,

Masters, PH. D. Program at a

university or other educational

institution.

-

Coinsurance 80% in PPO network within the U.S

-

Deductible of $150 or $500 per illness/injury

-

Maximum limit for Student: $100,000

-

Mental Health paid as any other

illness

-

Preexisting conditions (after a

6-month waiting period)

-

Maternity coverage ($5,000 max)

-

Includes COVID coverage

-

3 month

minimum purchase

|

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png)

Global Care Essential Overview

Doctors & Hospitals |

| |

| |

|

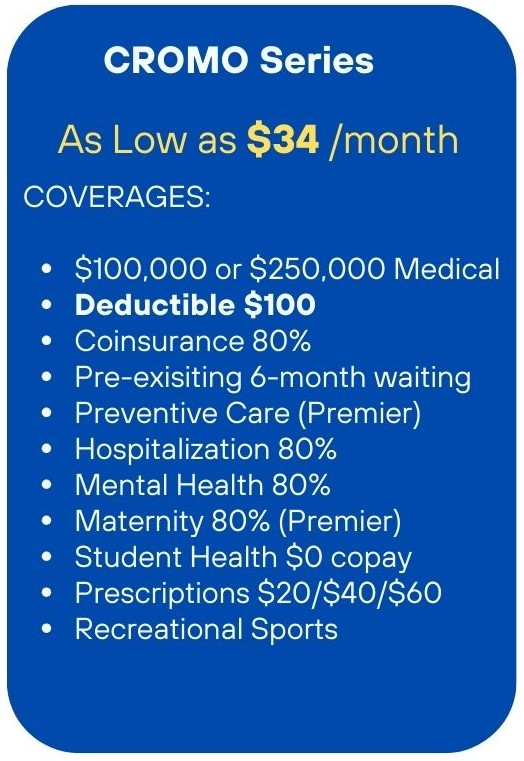

WellAway

CROMO

Coverage

For International STUDENTS Studying in the

USA ONLY

Choose from 2 Health

Plans specifically designed for

F-1,

M-1

and J-1

visa Undergraduate

and Graduate Students.

Coverage includes

$250,000 or $500,000 (Premier) Medical

Maximum, Maternity, Mental Health and COVID Coverage while

studying in the USA! Free comparison quotes

for all 2 Plans at once!Enroll ONLINE! |

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png)

CROMO Plan

Overview

Doctors & Hospitals |

| |

| |

|

WellAway

ROYAL

Coverage

For International STUDENTS Studying in the

USA ONLY

Choose from 3 Health

Plans specifically dedicated to

F-1,

M-1

&

J-1 visa

Undergraduate

and Graduate Students. J visa

holders please choose 100 or Plus to meet

J-visa requirements.

6 month minimum

purchase.

Coverage includes

Unlimited Medical, choice of Deductibles,

Maternity, Mental Health and COVID Coverage while

studying in the USA! Free comparison quotes

for all 3 Plans at once! Enroll ONLINE! |

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png) .png)

ROYAL Plan

Overview

Doctors & Hospitals |

| |

|

|

|

|

|

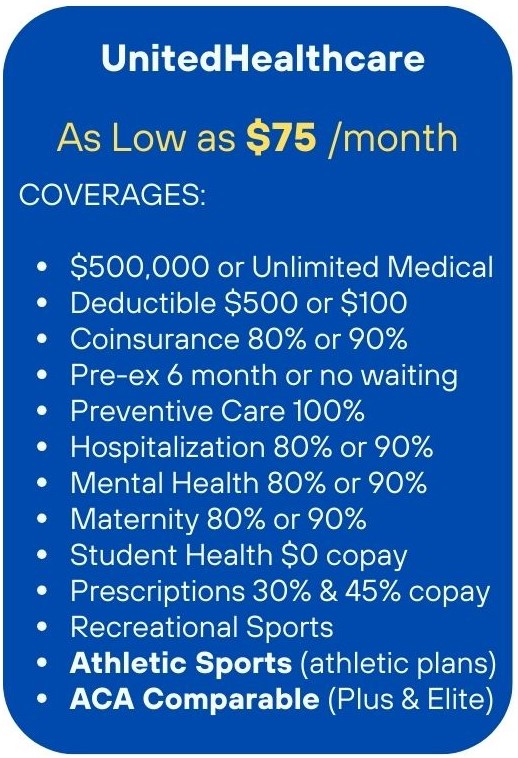

VISIT®

Global Care

Basic,

Plus,

Elite

-

Comprehensive

medical insurance for international

students or scholars participating in

educational activities Must be

enrolled in an Associates, Bachelors,

Masters, PH. D.

-

Coinsurance 80% in PPO network within the U.S

-

Deductible of $100 or $500 per illness/injury

-

Maximum limit for Student: $500,000 to

Unlimited

-

Mental Health paid as any other

illness

-

Preexisting conditions (after a

6-month waiting period or No waiting

Period on the ELITE Plan)

-

Maternity coverage

-

Includes COVID coverage

-

3 month

minimum purchase

*International Student Athletes -

Click here for Plans that include

Athletic Sports

|

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png) .png)

Global Care Basic

Global Care Plus

Global Care Elite

Doctors & Hospitals |

|

|

|

|

|

|

|

|

|

WellAway

Undergraduate STUDENT

Coverage For

International STUDENTS Studying in the USA ONLY

Choose from 3 Health

Plans specifically dedicated to

F-1

and

M-1 Undergraduate Students. Coverage includes

Unlimited (ACA) Medical, choice of Deductibles,

Maternity, Mental Health and COVID Coverage while

Studying in the USA! Free comparison quotes

for all 3 Plans at once! Enroll ONLINE!

|

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png) .png)

Doctors & Hospitals |

|

|

|

|

|

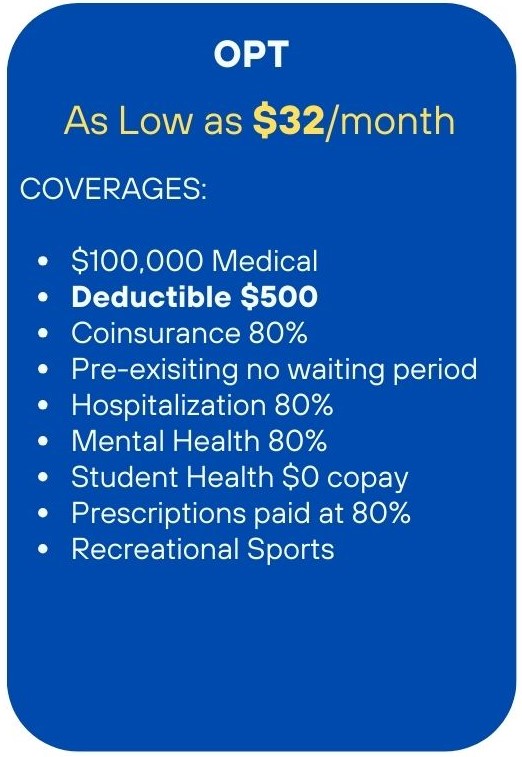

WellAway

OPT

Coverage For

International F-1 Students on OPT

A Health

Plan specifically dedicated to students on a

F-1 OPT visa. Coverage includes

$100,000 Medical, $500 Deductible,

Mental Health, and COVID Coverage! Enroll ONLINE!

|

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png)

Doctors & Hospitals |

|

|

|

|

|

|

Coverage

For International STUDENTS Studying in the

USA ONLY

WellAway’s

dedicated J-1 plans meet the

requirements of the U.S. Department of

State for scholars on a J-1 visa.

The J-1 categories are: J-1 Research

Scholar, J-1 Professor, or J-1

Short-Term Scholar.

We

understand the importance of education

and how peace of mind and well-being

directly impact learning and personal

growth. WellAway's J-1 Plans provide

the vital benefits and more, to

seamlessly navigate your world with

wellness and security. We have

knowledge and experience with reliable

solutions you can trust. The J-1 Plan

is designed to keep health expenses

low, while meeting university

requirements and the U.S. Department

of State regulations.

|

|

Essential

Coverage &

Includes Mental Health

.png) .png)

WellAway J-1 Plan

Overview

Doctors & Hospitals |

|

|

|

|

|

|

StudentSecure

Ideal for Any

International STUDENTS & STUDY ABROAD

Worldwide!

(Smart,

Budget, Select, Elite)

|

|

Choice of 4 Health

Plans for Students & Scholars (No

Dependents) that include COVID and Mental

Health coverage. SMART

includes essential coverage for Students

who don’t need Maternity or Pre-Existing

Conditions.

BUDGET

includes up to $5,000 Maternity and

Pre-Existing Conditions after 12 months’

continuous enrollment. SELECT

includes up to $10,000 Maternity and

Pre-Existing Conditions after 6 months. ELITE

includes up to $25,000 Maternity and

Pre-Existing Conditions after 6 months.

|

|

|

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png) .png)

StudentSecure

Overview

StudentSecure

Brochure

Watch Student

Secure Video

Doctors & Hospitals |

|

|

|

|

|

Student Health Advantage

(SHA)

Ideal for Any International

STUDENTS & STUDY ABROAD Worldwide!

(Standard &

Platinum)

-

Comprehensive medical insurance for

international students or scholars

participating in a sponsored study

abroad program

-

Coinsurance in PPO network or student

health center within the U.S.: Company

pays 90%

-

Deductible of $100 Standard / $250

Platinum per illness/injury

-

Maximum limit for Student: $500,000 or

$1,000,000

-

Provides coverage for mental health

-

Coverage for organized sports

(Platinum)

-

Preexisting conditions (after a

waiting period)

-

Maternity coverage (Platinum only)

-

Includes COVID coverage

|

Essential

Coverage &

Includes Mental Health

Includes Maternity

.png) .png) .png)

SHA Overview

SHA Brochure

Watch SHA Video

Doctors & Hospitals |

|

|

|

|

|

GeoBlue

Navigator

Ideal for Any

International STUDENTS & STUDY ABROAD

Worldwide!

-

Comprehensive

Medical Insurance for Students,

Scholars & Faculty Worldwide

-

Concierge-level benefits

-

Includes

Mental Health coverage

-

Preventive/Wellness Care coverage

-

Includes

coverage for pre-exisiting conditions

after a 12 month waiting period. (May

be waived with proof of prior

insurance coverage)

-

Blue Cross

Blue Shield medical provider network

-

Includes

COVID Coverage

Plan requires medical underwriting

|

Essential

Coverage &

Includes Mental Health

Includes

Pre-ex

(after 12 months)

Includes Maternity

(after 12

months)

Includes

Preventive Care

.png) .png) .png)

GeoBlue Overview

GeoBlue Brochure

Watch GeoBlue Navigator Video

Doctors & Hospitals |

|

|

|

|

|

Medical Evacuation & Repatriation

|

Medical

Evacuation/Repatriation Only

.png)

How to File a Claim |

|

|